Here to help you grow.

The Equipment You Need. The Flexibility You Deserve.

Smart, accessible financing to help you move faster, grow stronger, and get the tools to do the job.

.jpg)

.jpg)

A direct lender with 50+ lending partners, in-house underwriting, and a 90% approval rate, we don’t just say yes more—we say yes smarter.

Partnership Based on Trust

Your Trusted Equipment Financing Partner. Here to Help You Grow.

Equipment financing helps you acquire the tools, vehicles, and machines your business needs—without paying the full cost upfront. Instead, you make manageable monthly payments over time, while the equipment supports your revenue and growth.

This structure gives you access to the latest equipment, preserves your cash, and provides tax advantages—all without jumping through traditional bank hoops.

✔ Direct lender with in-house underwriting

✔ Access to 50+ specialized funding sources

✔ Digital-first tools with human-first support

✔ Straight-through processing to close deals faster

✔ Real people behind every deal, not bots or algorithms

in total funded volume since 2004

trusted lending partners in our national network

90% approval rate—for all types of credit profiles

We finance more than just equipment—we help you move your business forward. Use FPG financing for:

WE FINANCE

Medical Equipment

Secure the equipment you need to deliver better care—without draining your working capital.

WE FINANCE

Aesthetic Equipment

Offer more treatments, grow your brand, and stay competitive with flexible financing made for medspas and clinics.

%20(2)-1.png)

WE FINANCE

Dental Equipment

Modernize your practice, improve patient experience, and finance the tools that move your business forward.

WE FINANCE

Construction Equipment

Get the machines you need on-site—fast. Flexible terms built for job timelines and seasonal cash flow.

%20(1)-1.png)

WE FINANCE

Packaging & Manufacturing Equipment

Upgrade your production without slowing it down. Finance essential equipment built to scale your operation.

WE FINANCE

IT & Technology Equipment

Power your business with modern tech—servers, systems, and software—all with financing that works on your terms.

-1.png)

WE FINANCE

Heavy Equipment

From loaders to lifts, get fast access to the iron that keeps your operation moving.

WE FINANCE

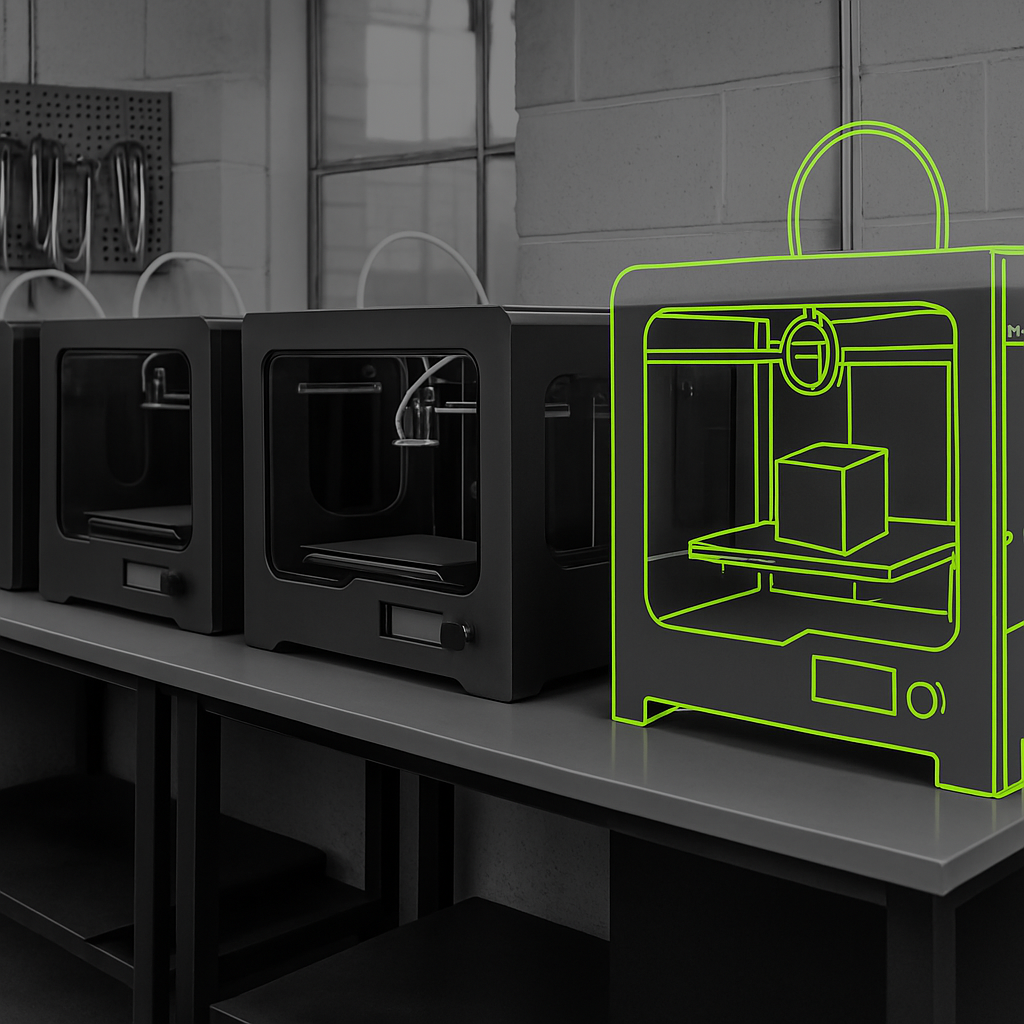

3D Printing & Advanced Manufacturing

Invest in the future of fabrication with financing designed for innovators, creators, and next-gen

.jpg?width=768&height=1408&name=image_fx%20(66).jpg)

.jpg?width=768&height=1408&name=image_fx%20(36).jpg)

Process Built to Move at Your Speed

Your Financing Partner in 3 Easy Steps

Financing shouldn’t be confusing. We built our process to be fast, flexible, and easy to understand—because we know you’ve got a business to run. Whether you’re applying for the first time or coming back for more, we make it simple from start to funded.

-

Apply in Minutes

→ No stacks of paperwork. Just a simple, streamlined application—online, by phone, or directly through your vendor. We’ll ask what we need to know—nothing more. -

Get Approved Fast

→ We don’t just check a score—we look at the full story. Most approvals come back within 4 hours, so you can keep your project, purchase, or business moving without delay. -

Get Funded, Get Growing

→ Once approved, we handle the contracts, funding, and follow-through. You’ll have a real person keeping you informed—and your financing ready when you are.

WHY CHOOSE FPG?

Not All Finance Partners Are Created Equal

FPG isn’t just here to fund the deal—we’re here to fuel your growth.

Our exclusive partner programs are built to drive sales and give back. From strategic incentives to co-branded marketing, we make sure our partners win when we do.

Whether you’re buying equipment, bridging a cash flow gap, or scaling to a new location, FPG brings the tools, expertise, and human-first support to make financing feel like an opportunity—not an obstacle.

-

What is equipment financing?

Equipment financing allows you to purchase or lease the equipment your business needs—without paying the full cost upfront. Instead, you spread payments over time, preserving your working capital while putting revenue-generating equipment to work immediately.

-

What types of equipment can I finance through FPG?

Just about anything essential to running or growing your business. That includes construction and heavy equipment, commercial vehicles and trucks, medical, dental, and veterinary equipment, aesthetic treatment systems, packaging and manufacturing machines, IT hardware, software, and POS systems, printers and CNC tools, furniture, fixtures, and more.

-

How fast is the approval process?

Fast. Most approvals are issued within 2–4 business hours. If additional information is needed, your dedicated FPG contact will let you know right away—no surprises, no delays.

-

Do I need perfect credit to qualify?

Not at all. We work with a wide range of credit profiles, including startups and growing businesses. As a direct lender with access to 25+ capital sources, we specialize in finding financing solutions that others can’t.

-

What are the financing terms?

We offer flexible terms, typically ranging from 12 to 84 months, depending on the equipment, your business profile, and your goals. Options include low upfront payments, seasonal structures, and various end-of-term buyouts.

-

What’s the difference between a lease and equipment financing?

Both give you access to equipment without paying in full up front. Leases may offer lower monthly payments and flexible end-of-term options (such as FMV buyouts), while equipment financing typically ends in full ownership. We'll help you choose the structure that best supports your business and cash flow.

-

Can I finance used equipment?

Yes, in most cases. We regularly finance both new and pre-owned equipment, depending on age, condition, and vendor. Reach out and we’ll review your specific scenario.

-

Do I need to work with a specific vendor to apply?

Nope. You can apply directly through FPG or through one of our 600+ vendor partners. If you already have a quote or preferred vendor, we’ll work with them to keep the process smooth.

-

How do I apply?

It’s easy. You can start online, through your vendor, or by speaking directly with an FPG financing expert. We’ll collect some basic business information and get to work right away.

Satisfied Clients

Derek W. | LUXURY CAR SALES & SERVICE

Satisfied Clients

Dr. Lucia Mirel-Chavez | OMG Las Vegas

product manager

Satisfied Clients

FPG Client | Equipment Financing Client

Satisfied Clients

FPG Client | Vendor Client

Satisfied Clients

FPG Client | Medical Equipment Provider

Satisfied Clients

FPG Client | Small Business Owner

Your business needs more than just equipment—it needs flexibility, resilience, and capital to grow.

FPG offers a range of financing and support solutions designed to keep you moving, no matter what comes next.

Ready to Fund What’s Next ?

Get a personalized financing plan designed for your business goals—with zero pressure, and no surprises.